.png)

LenderAI’s Application Flow: A Better Borrower Experience, a Smarter Lending Process

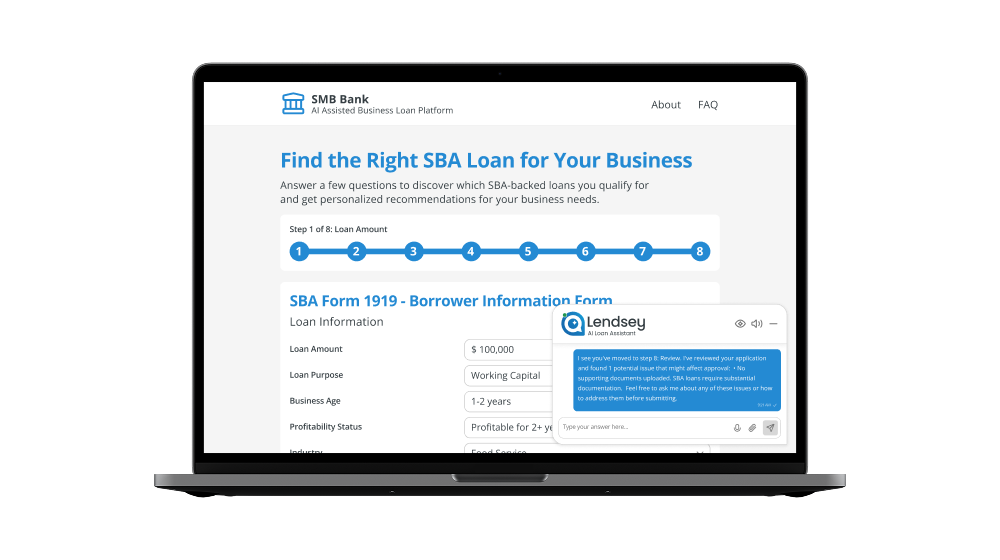

Applying for a business loan doesn’t have to be stressful for borrowers or lenders. LenderAI’s Application Flow allows lenders to offer clients a fully digital, user-friendly application experience that helps borrowers get started faster while streamlining the process for your lending team.

Easy for Borrowers, Anytime and Anywhere

LenderAI’s Application Flow gives borrowers the freedom to complete their loan application securely and conveniently—no branch visits or paperwork required. Whether they're at home, in the office, or on the beach, borrowers can apply at their own pace.

With Application Flow, your borrowers can:

- Work on their application 24/7 from any device

- Check initial eligibility before moving forward

- Upload all required documents in one secure place

- Ask Lendsey, our built-in AI assistant, questions for real-time support

It’s a modern experience designed to reduce friction, leading to more completed applications.

Tailored for Your Lending Workflow

Not only does Application Flow simplify things for borrowers, it also gives you full control over how applications are structured. You can customize everything to fit your lending team’s process and branding.

Key capabilities include:

- Custom application fields and question ordering

- White-labeled, branded applications to match your institution

- Ready-to-use templates if you don’t need customizations

- Control when sensitive info, such as SSNs, is requested

- Applicant opt-ins that support follow-up and marketing

- Optional Lendsey support to track activity and guide users

It’s flexibility where it matters, helping you convert more leads with less lift.

Gain Insight to Increase Conversion

Want to know where applicants are dropping off? Application Flow gives you visibility into the borrower journey so you can make smarter decisions and increase completion rates.

You’ll be able to:

- See exactly where borrowers paused or stopped their application

- Identify which sections may be causing friction

- Track completion in real time

- Use Lendsey to improve engagement and optimize your flow

These insights help you refine your digital application for higher impact.

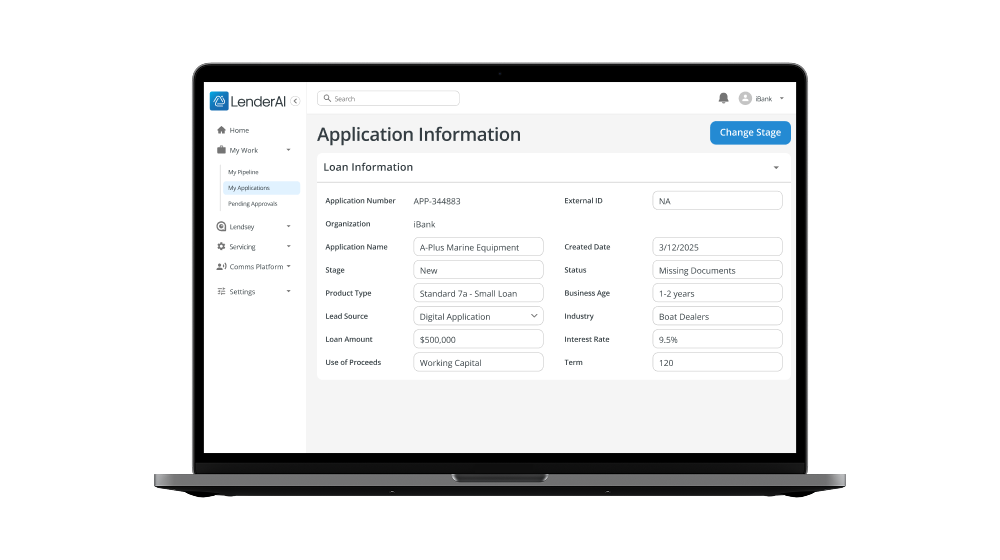

Seamless Sync with LenderAI

When you’re managing a high volume of loan applications, the fewer steps you have to invest time in, the better. Application Flow saves lenders time by automatically populating borrowers’ loan application information into LenderAI, so you won’t have to manually transfer it from one place to another.

Here’s what happens behind the scenes:

- Borrower data flows into LenderAI automatically

- You see what’s been submitted, what’s missing, and where each borrower left off

- Clients receive a secure email with a link to their portal

- You can request key documents (such as tax returns or bank statements) on your timeline

- Lendsey helps your team and borrowers complete the process quickly and correctly

The outcome is simplified document collection, communication, and loan processing.

The Bottom Line

With LenderAI’s Application Flow, you get a powerful tool that makes applying for a business loan easier for borrowers and more efficient for your team. The more quickly and efficiently you and your borrowers can move through the process, the faster each application gets funded and small business owners can move forward to meet their goals.

Learn more about LenderAI or reach out at go-ibf.com/Contact to see it in action.

.png)

.png)

.png)

.svg)