How Small Business Lending Supports American Jobs

There are currently 36.2 million small businesses in the United States, according to data from the Small Business Association (SBA). In the last year alone, small businesses contributed a net increase of 1.2 million jobs—an 89% increase for the nation. There’s no denying the impact small businesses make on our country and its economy, but that impact begins with the capital to make it happen.

While business owners help support the nation, lenders are supporting them, enabling them to expand operations, purchase equipment, and create jobs that bring more Americans into the workforce. Small business lending has a particularly measurable impact on U.S. job creation. Let's look more closely at how SBA funding drives the American job market.

The Role of Small Businesses in Job Creation

The SBA considers a small business one that has fewer than 500 employees. With that definition in mind, the U.S. Chamber of Commerce reports that 66.6 million Americans are employed by a small business. That’s 46% of the U.S. population. Another way to say that is: Small businesses are big employers. According to the same report, even businesses employing 10 to 19 people collectively add an average of over half a million jobs to the U.S. economy in a 10-year span. Given that applications to start new businesses continue to surge—with over five million new business applications filed annually since 2020—the influence of small businesses on job creation is only growing.

The Connection Between Access to Capital and Employment Growth

Loans are often the lifeblood of a business, enabling entrepreneurs to hire, train, and retain workers. This isn’t just the case when starting a business. Lending can have an impact at any point in a business’s lifetime. A working capital loan can mean hiring additional staff during holiday or busy seasons and make all the difference in that business being able to maximize earnings. For a business ready to rise to the next occasion, getting a loan can make it possible to bring on new team members that help create and power new markets that take a business to the next level.

Let’s look at the impact SBA 7(a) loans have had on job creation over the last decade alone. Using LenderAI Insights, powered by the latest SBA and FOIA data, we can see that small business lenders have approved $243,685 million in loans, supporting 5,344,069 jobs from 2015 to 2025.

Employment Growth by State

Here's how those numbers break down in terms of SBA lending impact on job growth by state. Unsurprisingly, lenders have helped create the most job opportunity in the highly populated, largely metropolitan states California, Florida, and Texas, which collectively have seen nearly 1.5 million small business jobs supported by SBA lending since 2015, according to our LenderAI Insights database. The state of New York isn’t far behind at just over $246,000 jobs.

The success of SBA lending in these states is driven not only by borrower need but also by the proactive participation of lenders who are vital in their local economic ecosystems. On the flip side, we can also see opportunity in states with low job growth. Targeted SBA lending could make a large impact in these markets by fueling growth in sectors such as agriculture, logistics, manufacturing, and local health care.

Lenders who understand state-level trends can tailor their strategies to close these geographic capital gaps, focus on these regions’ industry strengths, and support greater employment.

.png)

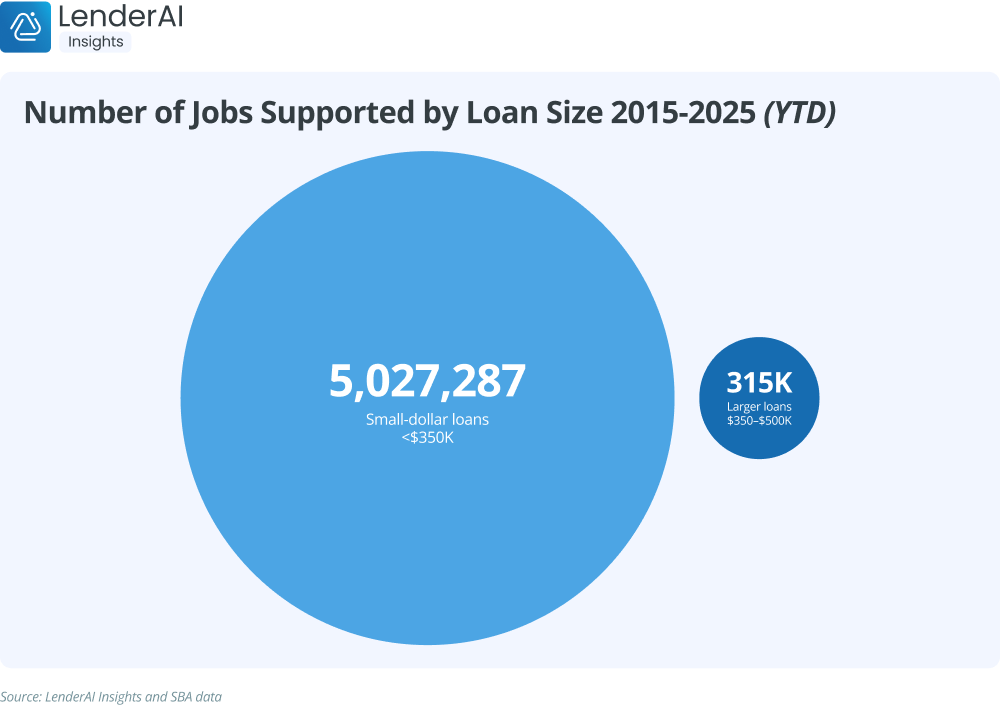

Employment Growth by Loan Size

Now let’s look at how loan size correlates with job opportunity. While there’s no strict definition for what’s considered a small- versus large-dollar loan, the SBA 7(a) loan program currently considers small-dollar loans those under $350,000. Since 2015, small-dollar loans have supported 5,027,287 jobs. Larger loans, from $350,000 to $500,000, have supported 314,847 in the same time span.

Often overlooked by traditional lenders, these smaller-dollar loans play a crucial role in job creation, particularly in their local areas. While larger loans may be supporting larger corporations with automation, overseas expansion, or mass production equipment, we find it likely that smaller operations requesting more modest dollar amounts are using that money largely to hire local employees to power their businesses.

We know that smaller-dollar loans are more accessible to startups and early-stage businesses—the types of enterprises that need to hire staff to grow but may not yet qualify for large financing. These smaller loans also tend to be spread across a wider range of borrowers, rather than concentrated in a few large enterprises. The result is a broader economic impact, especially in rural areas, low-income neighborhoods, and minority-owned business communities.

Lenders embracing smaller-dollar lending aren't just supporting small businesses—they're actively participating in grassroots economic growth. By supporting more small-dollar lending, lenders can maximize their impact on job creation while also increasing clients.

Employment Growth by Industry

Lending geared toward the Food Services industry made the biggest impact on job opportunities the past decade, at just over one million jobs supported. Sectors within Health Care and Social Services weren’t far behind. As technology, consumer behavior, and the economy change, we could see a job market shift.

In 2024, the U.S. Bureau of Labor Statistics projected that the country’s total employment would grow by 4%, or 6.7 million jobs, between 2023 and 2033. Around half of that growth would be in the Health Care and Social Assistance fields and the Professional, Scientific, and Technical Services sectors. The Bureau expects to see the most employment growth in the Health Care and Social Assistance industries, projected at over one-third of all new jobs. It expects the fastest growth spurt, however, in Professional, Scientific, and Technical Services jobs. The only sector expected to see a decline in jobs over the 2023–2033 decade is the retail trade due to continued e-commerce growth.

For lenders, this evolving landscape highlights the importance of industry-specific strategies. Supporting small businesses in these high-growth sectors not only positions lenders for stronger portfolio performance but also amplifies their impact on job creation.

.png)

Small Business Lending’s Impact on Economic Health

Lending isn’t just about providing capital. It’s a crucial ingredient in economic and personal livelihood. According to the Chamber of Commerce, small businesses pay employees $30.42 an hour on average, amounting to an annual salary of roughly $63,000. Given the Chamber of Commerce’s report of 66.6 million Americans being currently employed by small businesses, that’s over four trillion dollars circulating back into the economy.

And impact isn’t just about numbers. Small businesses drive innovation, constantly developing new products and services that improve quality of life and add to our country’s capabilities and achievements. When lenders support small businesses, they’re not just providing a means to hire employees or make purchases, they’re backing creativity and possibility.

What Can Lenders Do to Reduce Borrower Barriers and Fund More Jobs?

No growth, new jobs, or other significant changes are likely to happen for a business without adequate funding. For lenders to best support job creation, we have to remove the barriers keeping business owners from being able to expand and add staffing.

In the Q2 2025 MetLife and U.S. Chamber Small Business Index, 42% of surveyed business owners say they plan to increase staff in the next year, up from 37% last year. However, many report struggling to obtain the financing required to follow through on those plans, with top obstacles reported as:

- A time-consuming application process (52%)

- Not having enough information on available sources of capital (46%)

- Not having enough revenue or assets to qualify for a loan (46%)

To combat this and better support entrepreneurs, lenders can take targeted action in a few key areas:

- Improving the application process: An inconvenient loan process discourages busy small business owners, especially those that are short-staffed. Lenders with a digital, user-friendly application platform make the process quicker and more convenient for borrowers.

- Increasing outreach: Nearly half of respondents reported a lack of awareness around available financing options. This indicates a need for lenders to more proactively educate business owners. Offering one-on-one consultations or partnering with local business development centers can bridge the knowledge gap and build trust, especially among first-time borrowers.

- Embracing small-dollar loans: Many small businesses don’t need substantial financing to make their first hires. Offering smaller-dollar loans that are designed to meet immediate hiring or expansion needs can be a game-changer. Lenders that embrace microloan and express loan models not only widen their applicant pools but also enable job creation at the grassroots level.

When lenders rethink their products and processes through the lens of accessibility, they empower more small businesses to grow, hire, and contribute to the broader economy. Removing these financing hurdles doesn’t just benefit entrepreneurs, it strengthens entire communities through job creation and long-term economic resilience.

Final Thoughts

Capital is a business’s lifeline, and with every funded loan, a job is potentially created. Financially supporting small businesses means supporting America’s workforce. With LenderAI, our aim is to reduce those borrower barriers and help lenders fund more loans faster and smarter, fueling quicker job creation.

Schedule a demo to see how LenderAI can support your lending operations to become more efficient and fund more small business owners.

For access into the latest SBA data helping lenders explore industry trends, you can register for a free LenderAI Insights account. This database helps lenders take a deeper look at borrower profiles, track approval shifts, and tailor lending strategies in real time.

.png)

.png)

.png)

.svg)