The Average SBA Loan in 2025: Size, Term, and Interest Rate Trends

SBA loan trends in 2025 highlight a strong lending environment—one where more small businesses are gaining access to capital, loan amounts are becoming more tailored, and lenders are adapting to meet a wider range of needs. Using SBA data and real-time intelligence from LenderAI Insights*, we examined what the average SBA loan looks like in 2025 in terms of size, term length, and interest rate—three factors for lenders to be aware of to understand how lending behavior is influencing small business opportunity—and analyzed trends from 2021 to date to see how SBA lending is evolving.

The Average SBA 7(a) Loan Size in 2025

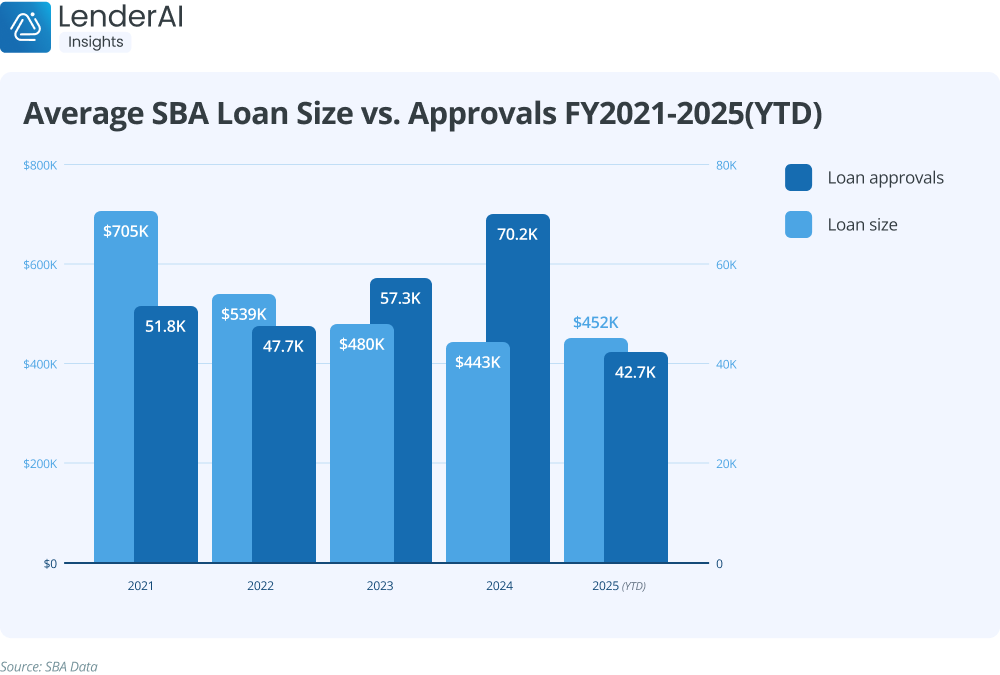

SBA data shows that the average 7(a) loan size so far in 2025 is $451,847. Although this figure is below FY2021’s average loan size of $704,581, a closer look at the number of loans approved so far in 2025 shows that nearly as many loans have been approved in FY2025 as were approved for the entirety of FY2021. This trend over the past five years of average loan sizes decreasing while the number of loan approvals increase could suggest that more businesses are receiving small-dollar loans, representing more entrepreneurs obtaining critical funding to support their business growth.

Other factors that could be resulting in the trend toward smaller loans are changes in borrower behavior and tighter lending standards. Small business owners could be asking for smaller loan amounts to fund specific, sustainable growth plans. Since the economic rebound post-2020, borrower demand has remained strong, supported by a surge in new business formations. Additionally, more women are applying for small business loans, and data shows that women both apply for and are approved for smaller loans.

Updates to SBA SOPs have encouraged lenders to focus more closely on credit quality, strengthening portfolios by working with borrowers who demonstrate solid financial fundamentals. While this may lead to fewer large loans overall, it helps ensure that funding continues to flow to well-positioned businesses across the country.

With these trends in motion, we’re likely to see more than 80,000 7(a) loans approved in 2025, a nearly 50% increase from 2021. This indicates high engagement from borrowers and growing efficiency among lenders.

Average SBA Loan Size by Business Type

In recent years, loans for LLCs, sole proprietorships, and LLPs were below average in size, while corporations were larger. But, in looking at loan approvals by business type, we can see just how much loan approvals are on the rise for all business types, particularly for LLCs. LLC gross approvals have ranged from roughly 30,000 to 43,000 in recent years but have received well over 38,000 approvals in just the first half of FY2025. The uptick in approvals in Q1 and Q2 suggests a quickly growing demand from borrowers for funding along with better borrower creditworthiness.

Average SBA Loan Size by Industry

Though the total average SBA loan size has gotten slimmer in recent years, five industries still secure loans considerably above the average:

- Accommodation and Food Services

- Health Care and Social Services

- Retail Trade

- Wholesale Trade

These industries have seen a roughly 22% average increase in loan approvals year over year from FY2021 to FY2024, but approval numbers for the first half of 2025 show that this year’s approvals will well surpass 2024. Wholesale trades, Health Care and Social Assistance, and Accommodation and Food Services have seen the biggest spike, indicating stability and growth for these markets.

All five industries drive consistent loan volume, offering prime opportunities for lenders. As high-potential borrowers, they warrant a deeper understanding of each industry’s financial norms and where they may be ideal candidates for bundled products.

Average SBA Loan Size by Business Size

While average loan sizes have decreased overall, we can see that the number of loans approved has risen steadily. Notably, businesses with five or fewer employees and those with 11 to 25 employees are seeing notable increases in loan size in FY2025. This trend suggests that smaller businesses are showing strong performance metrics or that lenders are identifying new ways to serve these borrowers effectively. It's a signal that smaller companies are being better supported and are gaining traction as strong loan candidates.

Microbusinesses in particular are playing a big role in loan volume this year. Between larger average loan sizes and high approvals for businesses with five or fewer employees, lenders may want to consider tailoring offerings to support these smaller operations through more term flexibility and faster loan origination processes.

The Average SBA 7(a) Loan Term in 2025

Average loan terms in 2025 are just under 15 years, a slight shift from the nearly 18-year terms seen in 2021. While average loan sizes have decreased significantly, term lengths have declined more moderately over the past five years, suggesting that monthly payments remain manageable and aligned with borrower needs.

While the average loan size has dropped by 36% since 2021, the average term length has only decreased by 16.8%. This supports the idea that repayment experiences are smoother and reflects loan structures that fit the realities of today’s small businesses.

What Do Shorter Loan Terms Indicate?

The steady decline in term length since 2021 suggests adaptability rather than caution. In a market shaped by interest rate changes, both lenders and borrowers are aligning around shorter-term financing strategies. Many SBA lenders may also be focused on bringing portfolio-wide averages down by offering more short-term working capital loans, often below $250,000 with terms under seven years.

Borrowers, in turn, may be proactively choosing shorter terms to reduce interest exposure and build financial flexibility as they scale.

The Average SBA 7(a) Loan Interest Rates in 2025

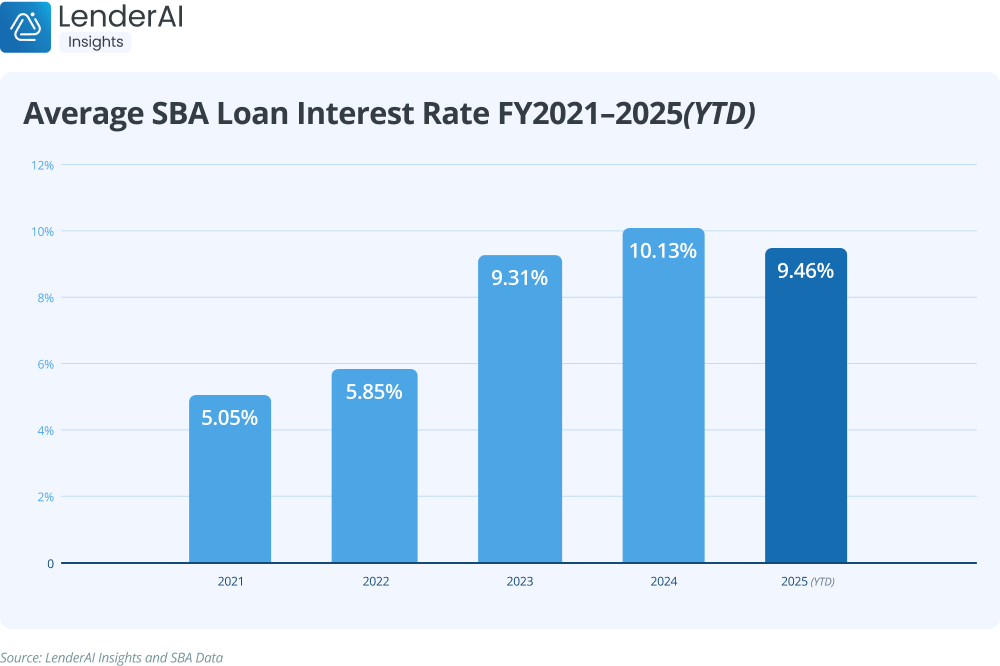

To date in 2025, the weighted average interest rate is 9.46%. The Federal Reserve prime rate has steadily increased in recent years—from 3.25% in 2021 to 7.5% today—leading to increasing interest rates for small business loans. Borrowers in 2022 saw an average interest rate of 5.85%, while today’s average is 9.46%. Though rates have been on an incline, so far the average rate in FY2025 is 0.67% lower than FY2024. This is encouraging for borrowers considering the prime rate increased in December 2024.

This small decline in the average rate suggests that lenders are finding ways to stay competitive while still managing portfolio performance. It also shows that borrowers remain highly engaged and motivated to secure funding, even in a higher-rate environment.

How Can Lenders Help Small Businesses Manage Interest Rates?

Loan lenders play an important role in helping small businesses and their owners remain financially healthy. To maintain competitiveness and manage risk while supporting loan clients, lenders can consider the following:

- Longer term lengths: Lower monthly payments can make a huge difference for small business owners combatting high interest rates.

- Interest-only periods: Some lenders may want to offer temporarily reduced payments during businesses’ startup phase or slower periods. Alternatively, it could be helpful to let businesses start with a lower payment plan and increase as revenue grows.

- Refinancing: Where it makes sense, lenders can help clients refinance variable-rate debt into fixed-rate products before rates rise again.

- Bundling incentives: Lenders can make the decision to offer rate incentives or reduced fees for lower-risk clients who bundle products.

Affordable funding is essential to keeping American small businesses afloat. By staying transparent and supportive, lenders can continue to build trust while helping borrowers grow confidently.

Key Takeaways for SBA Lenders

2025 is shaping up to be a strong year for SBA lending, with several key themes emerging:

- Though average loan size has decreased in recent years, loan approvals have increased, with FY2025 on track to outpace 2024.

- Higher loan size averages in FY2025 for businesses with five or fewer employees compared to last year may signify growing health for the smallest of the small businesses as well as a growing confidence in the market conditions.

- Both lenders and borrowers show signs of desiring shorter loan terms.

- Higher-than-normal interest rates continue to impact loan demand, but rising loan approvals show that borrowers are eager for expansion and funding, and lenders are seeing cause for greater confidence in smaller businesses.

- The adoption of tech platforms like LenderAI to originate loans has led to increased efficiency and the ability to help more borrowers, resulting in increasing numbers of loan approvals year over year.

Final Thoughts

Small business lenders and owners alike are staying proactive in today’s dynamic economic landscape. By paying attention to emerging trends in loan size, structure, and interest rates, lenders can continue to offer the right mix of products and advice. With the right tools and insights, lenders are not only managing risk but also expanding opportunity for the small businesses that power the U.S. economy.

Start with information. Create or log in to your free LenderAI Insights account to stay up to date on what the most recent SBA data has to say about borrowing and lending trends.

*All SBA and LenderAI Insights data is accurate as of July 11, 2025.

.png)

.png)

.png)

.svg)